Quiet optimism amid familiar patterns

By Neil Cooper-Smith, senior analyst, Business Pilot.

As we close the page on 2025, December’s data shows a mixed, but not unfamiliar, close to what was a steady year of adjustment for the sector. A seasonally expected slowdown was reflected across several metrics, but there are glimmers of positivity, particularly in buyer commitment, that suggest a solid foundation for 2026.

Conversion rates continued their upward trend, rising from 41.4% in November to 42.8% in December. That marks the strongest conversion figure of the year, and it’s a good note to end on. Consumers appear to be more decisive when they do engage, a pattern that emerged clearly in the second half of 2025.

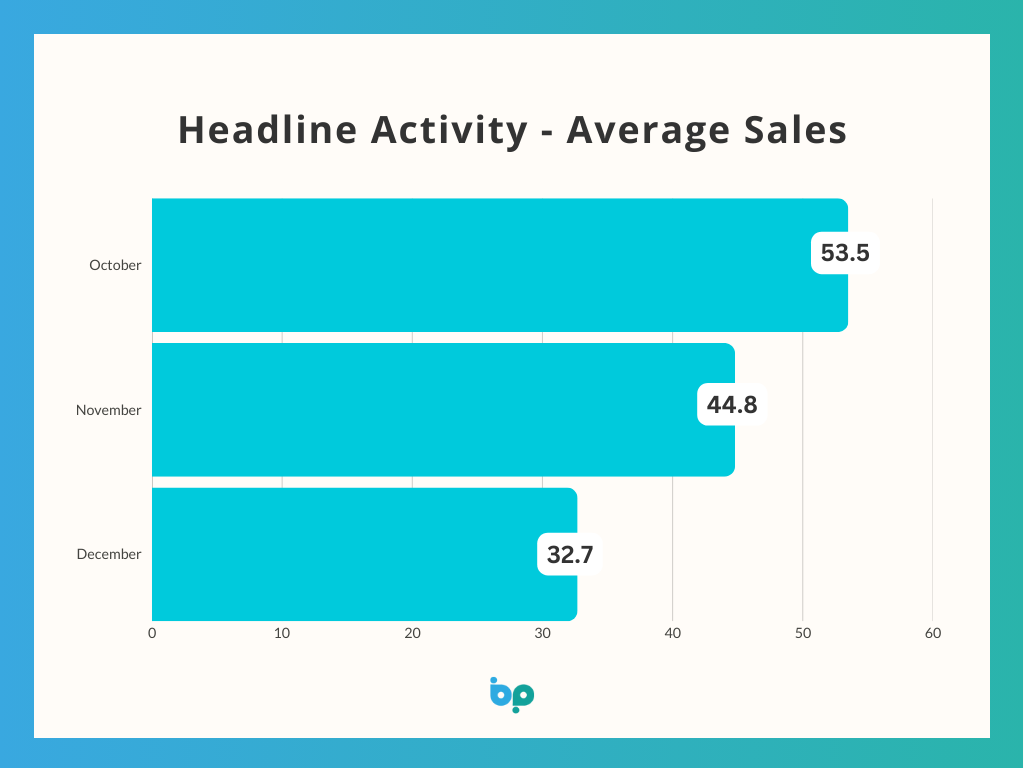

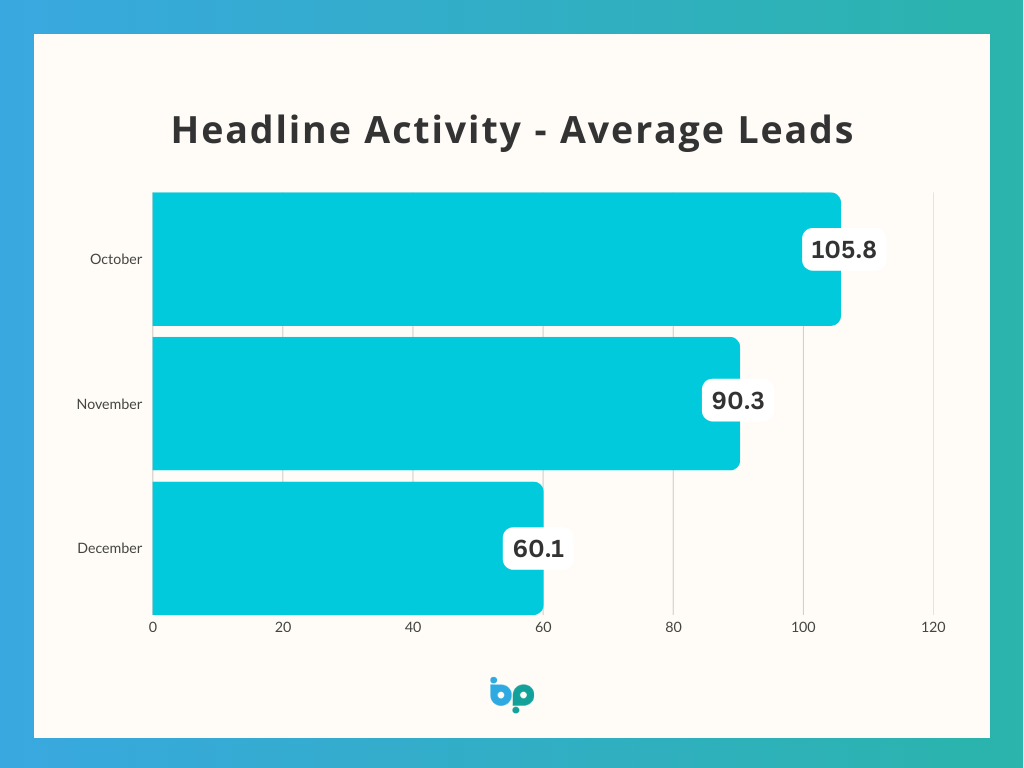

But as to be expected during December, average lead volumes dropped by 33.5% – the lowest volume recorded in 2025. This mirrors typical seasonal behaviour, with homeowners shifting their focus during the festive period. Sales volumes also declined, dropping by 27% in December. While a seemingly significant drop on paper, again, this is very much in line with the slower activity we see each December and should not be over-interpreted.

Average order values modestly ticked up, rising from £3,665 in November to £3,710 in December. While still down compared to October’s peak of £4,647, the rebound from November is encouraging and may reflect a rebalancing toward mid-range installations. In uncertain times, homeowners often prioritise reliable and reactive improvements over premium upgrades, and we believe this is now playing out across order patterns.

Zooming out, the broader UK economic picture at year-end offers cautious grounds for optimism. In December, the Bank of England’s Monetary Policy Committee voted narrowly to cut the base interest rate from 4% to 3.75 % – its lowest level in almost three years. At the same time, inflation slowed to 3.2% in November 2025, down from 3.6% in October, and well below the peaks seen earlier in the year.

This downward trend brings inflation closer to the Bank of England’s 2% target and reinforces market expectations that price pressures are gradually loosening after several years of elevated costs. Lower inflation can help support household budgets and, in turn, consumer spending on big‑ticket home improvements – an important backdrop for demand in the window and door retail sector.

So, what does this mean for installers heading into the new year? While the headline numbers for December reflect the expected seasonal lull, the steady increase in conversion rates, and the small rebound in order value, suggest that when the enquiries do come, they’re increasingly serious. That’s a trend worth building on. With consumer confidence slowly stabilising, and inflation pressures easing, 2026 could bring opportunity for those ready to move fast and act decisively.

From everyone at Business Pilot, we’d like to thank our installer community for another year of insight and resilience. We’re proud to support your growth with the data and tools you need to keep improving. Here’s to a confident start to 2026.