Seasonal slowdown amid economic caution

By Neil Cooper-Smith, senior analyst, Business Pilot.

As we move through the final months of the year, the data reflects a market responding in a way that aligns closely with typical seasonal patterns.

Activity held steady through September and October before softening into November, a shift that is consistent with the period and indicative of homeowners becoming more measured in their decision-making as winter approaches.

Conversion rates have been one of the more stable indicators, rising from 39.8% in September, to 40.7% in October, and 41.4% in November. This steady upward trend suggests that although enquiry levels fluctuate, those progressing into the sales pipeline are generally committed and well qualified.

Installers appear to be managing these opportunities effectively, maintaining strong engagement even as overall activity eases. The resilience in conversion performance at this point in the year demonstrates that businesses are continuing to secure work from a more selective pool of prospects.

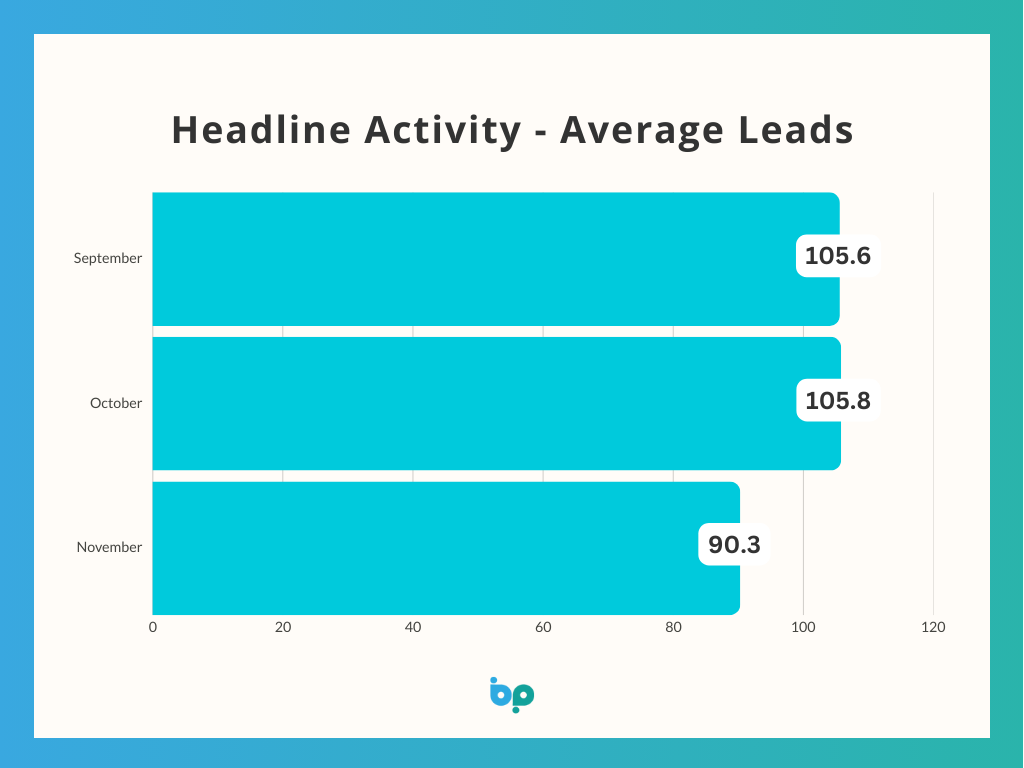

Lead volumes remained relatively flat between September (105.6) and October (105.8), a minor 0.2% increase that points to consistent early-autumn demand. However, the drop to 90.3 in November represents a more pronounced 14.6% decline, reflecting the familiar seasonal slowdown as households divert attention toward Christmas and delay non-essential decisions until the New Year.

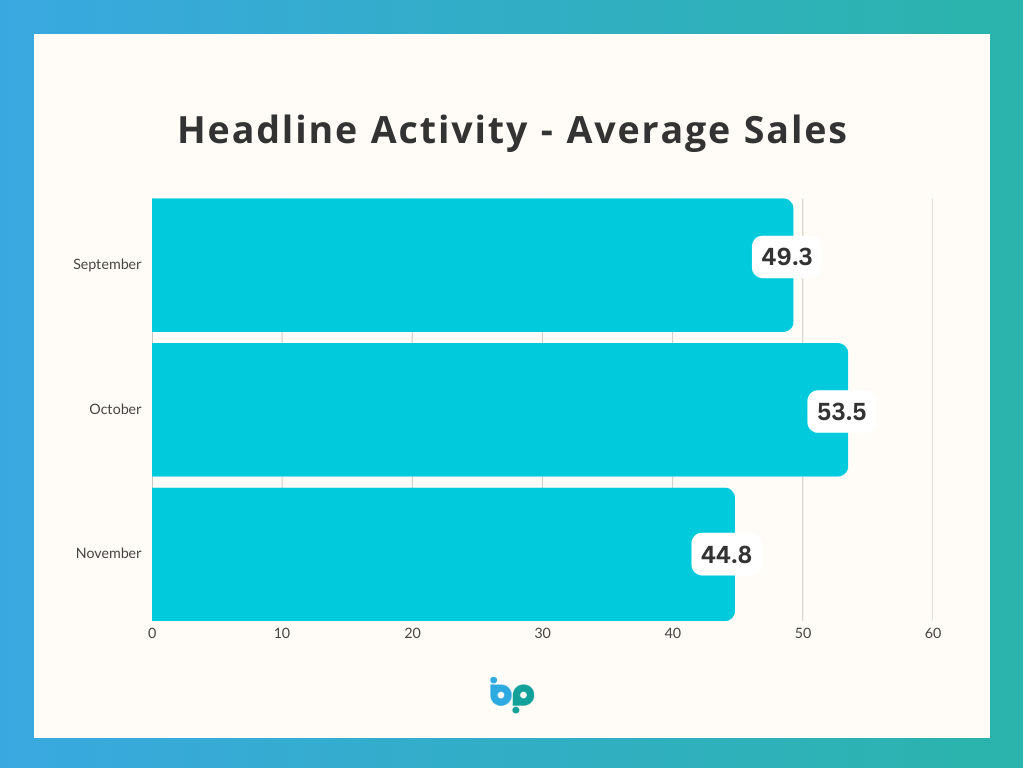

Sales figures followed a similar trajectory. Volumes rose from 49.3 in September to 53.5 in October, an 8.5% increase, before slumping 16.3% to 44.8 for November – a level more in line with what we tend to see heading into winter. This mirrors historical behaviour, October often bringing a final push before year-end planning and budgeting take over, where installers experience a short burst of activity before a predictable contraction in demand.

Average order values showed greater variation across the period. October saw a marked increase to £4,647.84 from £3,736.31 in September, reflecting a strong month for higher value projects as homeowners committed to larger installations ahead of winter.

November’s reduction to £3,665.75 represents a return to more typical levels, consistent with households prioritising seasonal and day-to-day spending over bigger ticket improvements as the year-end approaches.

Lead times continued their downward trend, falling 3.7% from 27 days in September to 26 days in October, and then decreasing a further 11.5% to 23 days in November. This highlights both a natural push to complete work before the end of the year and customers acting more decisively where seasonal factors, such as energy-efficient improvements, play a key role. It also reflects continued improvements in operational efficiency despite fluctuating volumes.

All of this sits against a backdrop of ongoing economic caution. Following the uncertainty driven by the recent Budget, and with inflation still above the Bank of England’s target while mortgage rates remain elevated, many homeowners are taking a measured approach to financial commitments. The steadiness seen early in the quarter, followed by November’s predictable cooling, points to a market that remains active but increasingly sensitive to wider pressures.

For installers, the message is clear: every opportunity carries more weight as we head into the New Year. Maintaining strong pipeline visibility and consistent engagement will ensure you are in the best position to convert meaningful interest into confirmed work.

If you’re not already using Business Pilot, now’s the time to see how this kind of insight can help you fine-tune your strategy. From tracking leads and conversions to optimising your sales process, Business Pilot arms you with the data and tools you need to drive growth.