Hints of New Year momentum

By Neil Cooper-Smith, senior analyst, Business Pilot.

January is often a month of reset, and this year has been no exception. With the dust now settling after the festive break, the latest Business Pilot Barometer data gives us a clear view of how installers returned to work, and how consumers have re-engaged with the market.

On balance, the start of 2026 presents a solid, if cautious picture, shaped by ongoing economic uncertainty but also marked by encouraging signs of underlying demand.

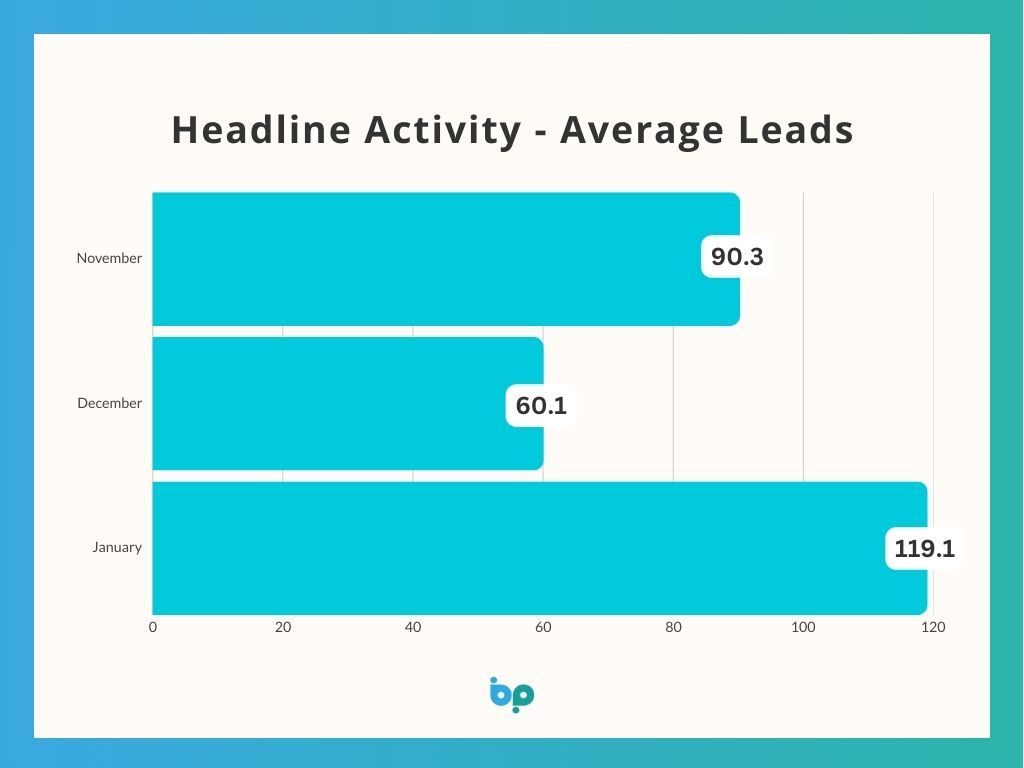

Lead volumes almost doubled compared to December, rising by 98.3% – a strong rebound that’s in line with the seasonal pattern we’ve come to expect. However, it’s worth noting that comparing January 2025 and January 2026 reveals a modest year-on-year softening of around 4%, suggesting that while consumer enquiry levels remain high, the market has returned at a slightly more cautious pace than at the same point last year.

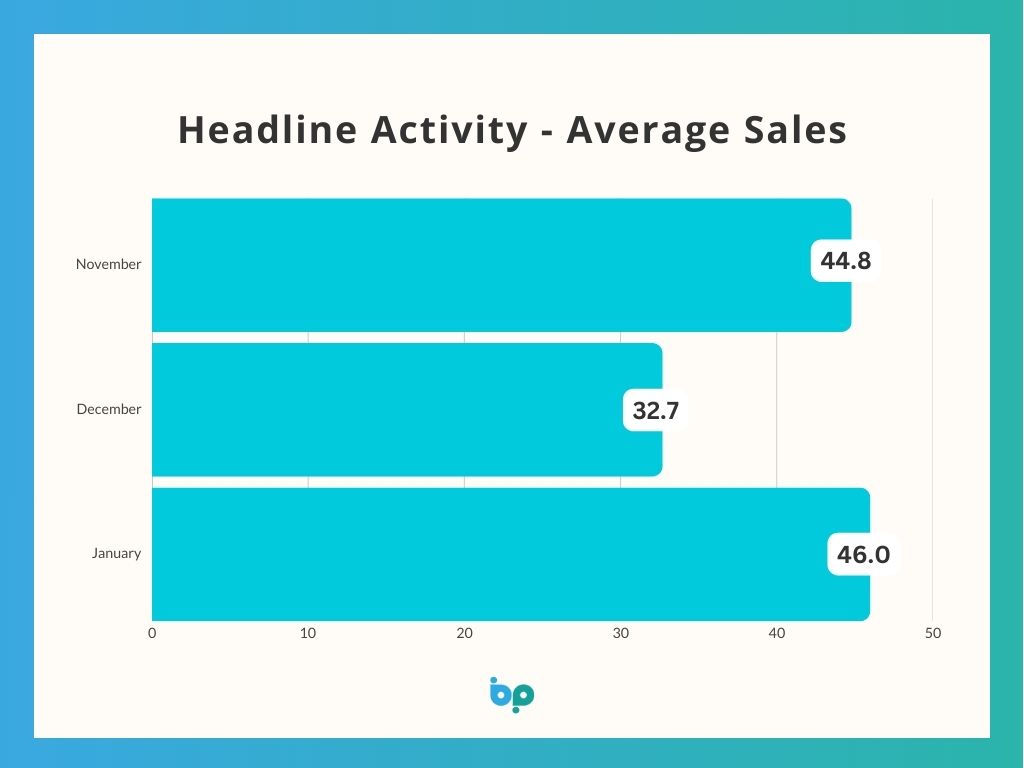

Sales volumes remained broadly in line with January 2025 numbers, and climbed 41% from December, which is no small feat in what is typically a stop-start month for confirmed orders.

Still, conversion fell from 42.8% in December to 38.4% in January, representing a 10% decline. On its own, that might raise eyebrows, but when placed in context, this again reflects a familiar seasonal pattern. January 2025 also recorded a similar drop in conversion rates, reinforcing that lower conversions at the start of the year are more about sales cycles resetting than any deterioration in buyer intent.

Interestingly however, those customers who are converting are spending more. Average order values rose by 6.8%, increasing from £3,710 in December to £3,962 in January. Not only is this a strong month-on-month gain, but it also represents a marginally stronger January position than in 2025. This growth supports the view that while homeowners remain hesitant, those who are proceeding are committing to larger, more considered projects.

This picture aligns closely with an uncertain and unpredictable economic backdrop. The Bank of England’s Monetary Policy Committee (MPC) is widely anticipated to leave borrowing costs unchanged when it announces its latest decision this month, marking its first interest rate setting meeting of the year.

Consumer confidence also remains fragile. The GfK Consumer Confidence Index rose by just one point to -16 in January, marking ten full years in negative territory. While households feel slightly more positive about their personal finances, sentiment toward the wider economy is still in the red. This disconnect between cautious outlooks and selective spending is echoed in our data. Homeowners are enquiring and even spending more, but many are still moving cautiously through the buying journey.

But another layer to this picture lies in the polarisation of consumer behaviour across age groups. Recent BBC analysis highlights how younger consumers are benefiting from falling interest rates, boosting their ability to plan for large purchases like home improvements. In contrast, older consumers, many of whom are net savers, are reportedly sitting on unusually high savings, spending cautiously, and weighing down broader GDP growth.

For installers, this means understanding buyer intent is more important than ever. Tools like Business Pilot help separate high-value leads from less committed enquiries, enabling teams to focus follow-up where the likelihood of sale is highest, maximising return on effort and securing business. Installers who continue to focus on quality lead management, precise quoting, and efficient conversion will be best positioned to make the most of the opportunities that this quarter brings.