Cautious optimism

Neil Cooper-Smith, senior analyst, Business Pilot.

September’s data shows a mixed but cautiously encouraging picture for the retail window and door sector, with improvements in leads and sales compared to August, but pressures emerging in conversion rates and the speed of customer decision-making.

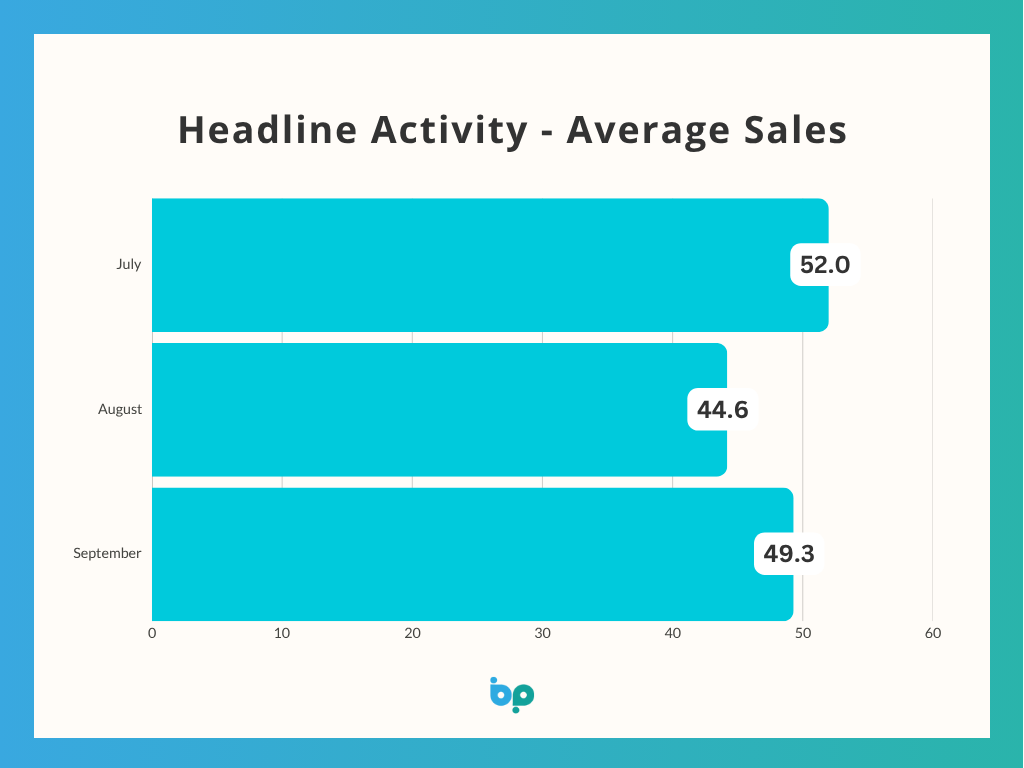

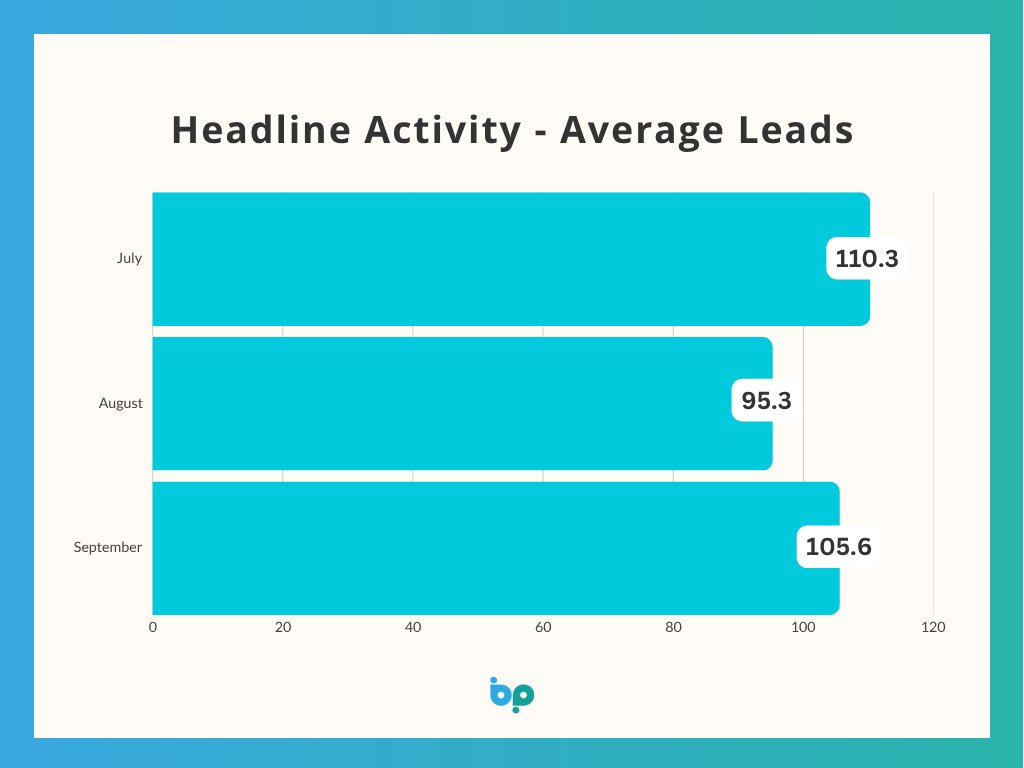

Headline activity picked up after a sluggish August. Average leads rose from 95.3 to 105.6, a strong 10.8% increase that brings volumes closer to July’s benchmark of 110.3. This rebound suggests that consumer appetite has not disappeared, even in the face of economic uncertainty.

Sales followed suit, rising from 44.6 in August to 49.3 in September, an impressive 10.5% increase and clear evidence that homeowners remain willing to commit to projects when confidence returns.

That said, conversion rates continued to ease back, slipping from 40.8% in August to 39.8% in September. While this is only a one percentage point decline, it marks the second month of softening and indicates that installers are having to work harder to secure orders despite the uplift in enquiries.

Average order values held broadly steady, shifting from £3,767 in August to £3,736 in September – a minimal £31 decrease, indicating that spending patterns remain consistent.

Perhaps the most notable shift in the September’s data is in lead times. This figure stretched from 23 days in August to 27.3 days in September – an 18.7% increase – demonstrating that customers are taking longer to commit. This reflects a more cautious consumer mindset, with homeowners weighing up financial commitments carefully before signing off on home improvements.

Broader macroeconomic conditions remain a backdrop to these shifts. Inflation, which spiked mid-summer, is expected to remain above target into the autumn, keeping pressure on household budgets. Meanwhile, although interest rates were held steady in September, prices are still rising at nearly twice the Bank of England’s target rate.

Despite this, and the uncertainty preceding the Chancellor’s Autumn Budget, September’s uplift in leads and sales suggests that the market is tired of waiting. We’re seeing modest growth in some of our key indicators, demonstrating that homeowners are still investing in their homes – albeit cautiously.

For installers, the message is clear: volumes are still there, but efficiency, pipeline management, and margin discipline are key. With homeowners taking longer to decide, strong follow-up and engagement processes, supported by Business Pilot, will ensure that no opportunities are lost along the way.