Third wave of demand in the autumn?

By Neil Cooper-Smith, senior analyst at Business Pilot.

Having seen a drop of 12% in May on April, average sales jumped by 14% in June on May, putting window and door sales back firmly on an upward trajectory.

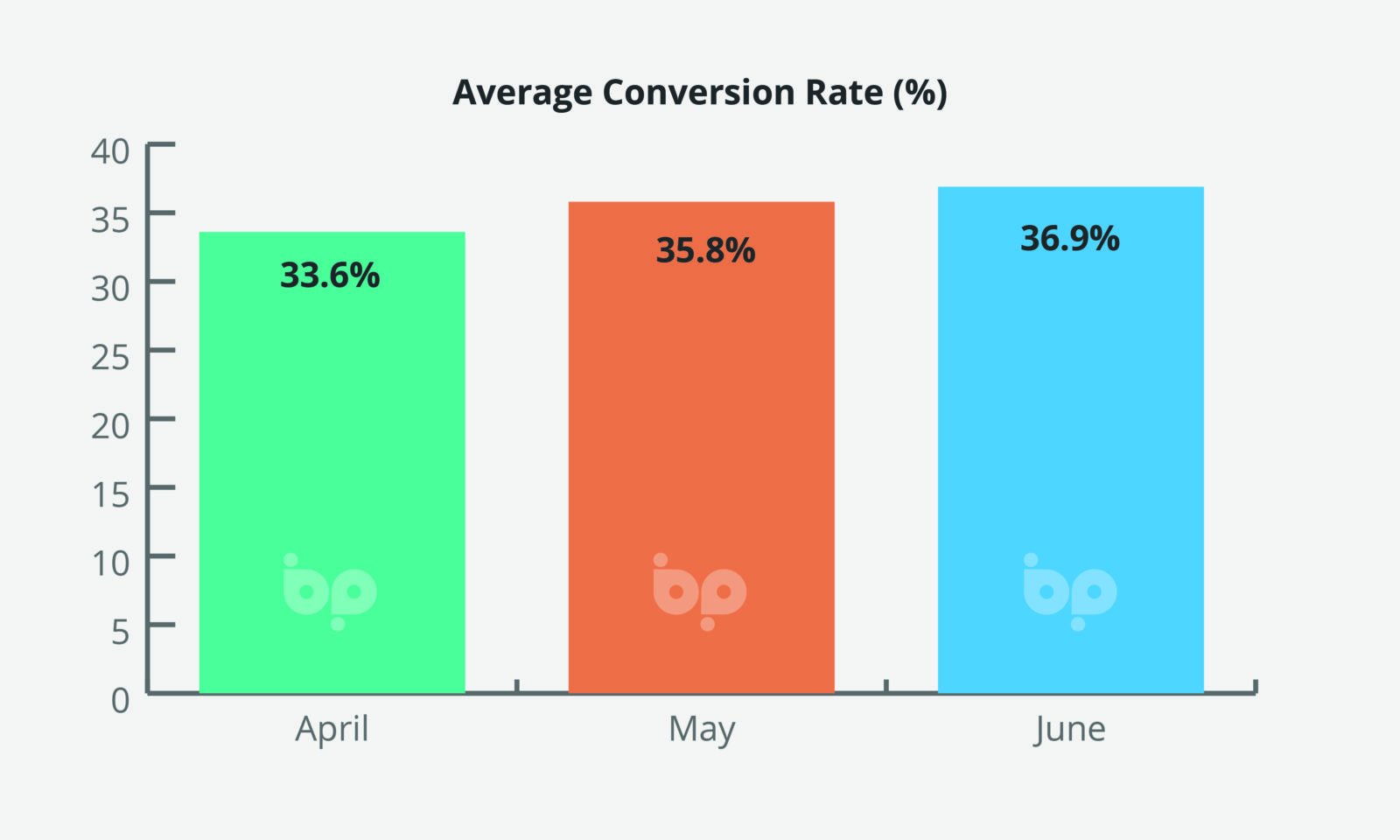

Conversion rates were also up marginally month on month from 35.8% to 36.9%.

Leads were also up 12% June on May, for the most part cancelling out the 14% drop in leads seen the previous month.

While there is little sign of the market cooling anytime soon, there was, however, a significant drop (32%) in average order values from around the £6,400 mark to £4,400. This may be attributable to seasonality, with more single product purchases – eg, bifolding and entrance doors – flowing through the sales pipeline.

We do think that it’s something to watch and may suggest that the spend generated by the first round of Stamp Duty completions at the end of March may have flowed through the sales pipeline. That doesn’t necessarily mean the boom is running out of steam, with a second stampede seen last month ahead of changes to the relief at the start of this month. This sees the previous break on the first £500,000 of a home purchase, which has driven the housing boom, drop to £250,000, ahead of being phased out entirely from October 1.

In real terms that means that anyone completing this side of the cut-off point will see their potential Stamp Duty saving drop from £15,000 to £2,500.

While we wouldn’t want to nail our colours to the flag on this, if demand follows the same pattern as seen from the previous cut-off point in March, we could expect to see another increase in demand late August and through to October.

After that, while some of the savings made in Stamp Duty by house buyers may continue to trickle through, we believe new consumer spend on home improvements may start to slow. Continuing supply issues and extended order books mean that this will not, however, translate into any significant slowdown in the market this year.

Supply chain security remains the sector’s greatest challenge in the immediate term. Steel and resin prices have continued to rocket and glass supply remains disrupted. This is something compounded last month by national shortages in delivery drivers and additional complexity at ports.

Economists warn that despite positive order books now, wider disruption to component, material and product supply in the economy as a whole – not only construction – has the potential to derail recovery.

We’d add that closer to home, installers are losing margin on jobs because of supply challenges. Understanding those and pricing them into the job is more important than ever.

We can help you do that by giving you full visibility of costs against each job you complete as well as real time reporting on your profitability. We can also help you to manage disruption to supply chain, through simple drag and drop job scheduling.