The year so far…and what’s coming next

Business Pilot’s managing director, Elton Boocock, analyses the last six months of data from the Business Pilot Barometer and talks about what installers can expect from the market over the next six months.

Six months into 2025 and I think we can all agree, it hasn’t been plain sailing this year. From what we’re hearing anecdotally, it’s a mixed bag out there. Some installers are busy and booked well into the Autumn, whilst others are reporting a slow and difficult market.

With the wider economic and geopolitical landscape in flux, it’s no surprise that consumer confidence is on shaky ground. While the Bank of England has gradually lowered interest rates over the past six months, inflation remains stubbornly above the 2% target.

Add to that the constant headlines about tariffs, conflict, and the rising cost of living, and uncertainty is the only certainty.

January-June 2025 Barometer Data

With all that happening, you would think that the retail window and door market would be completely unpredictable, but, whilst we have seen drops in leads and sales compared with the same period in 2024 and 2025, month-to-month things are steady.

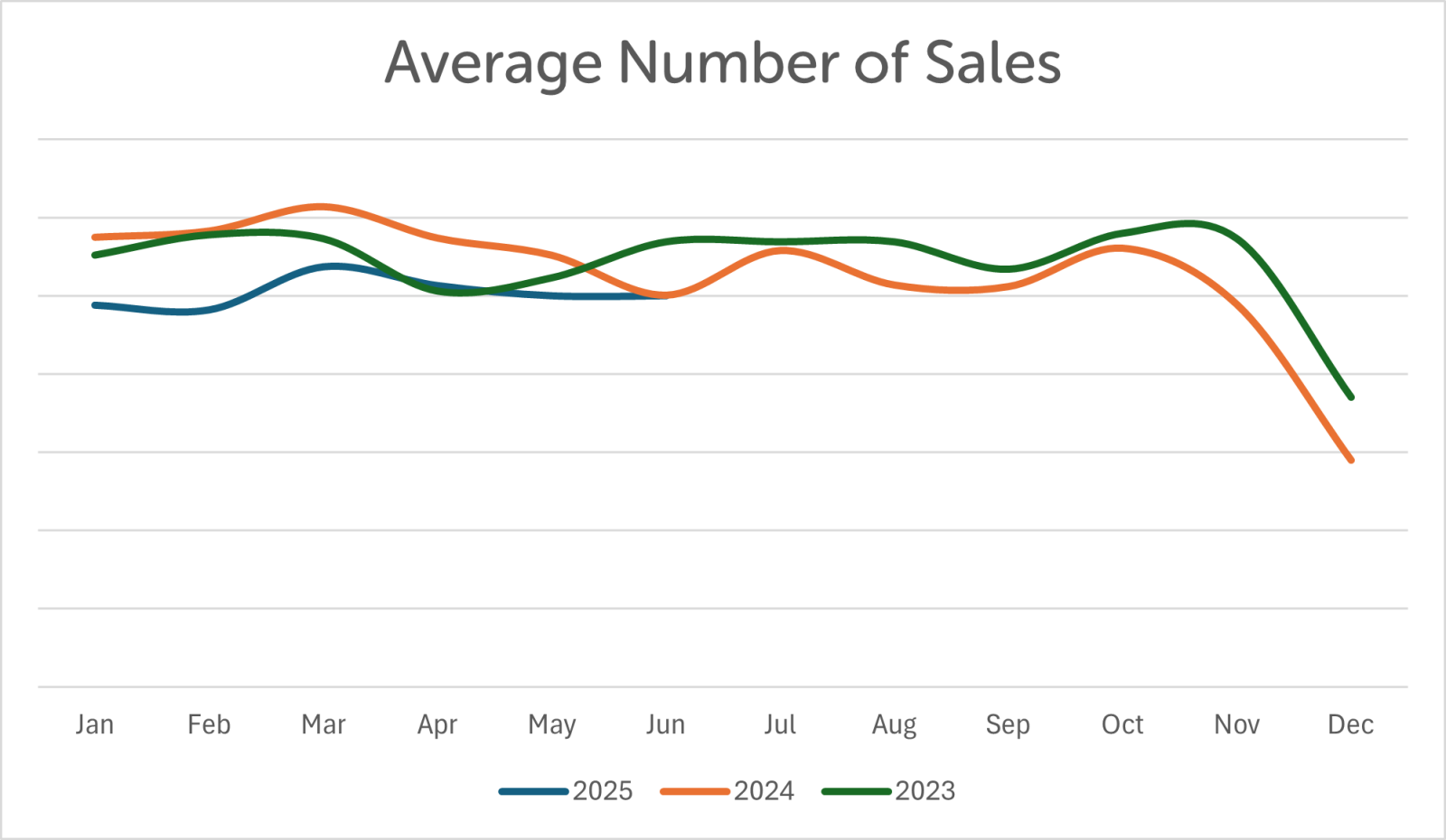

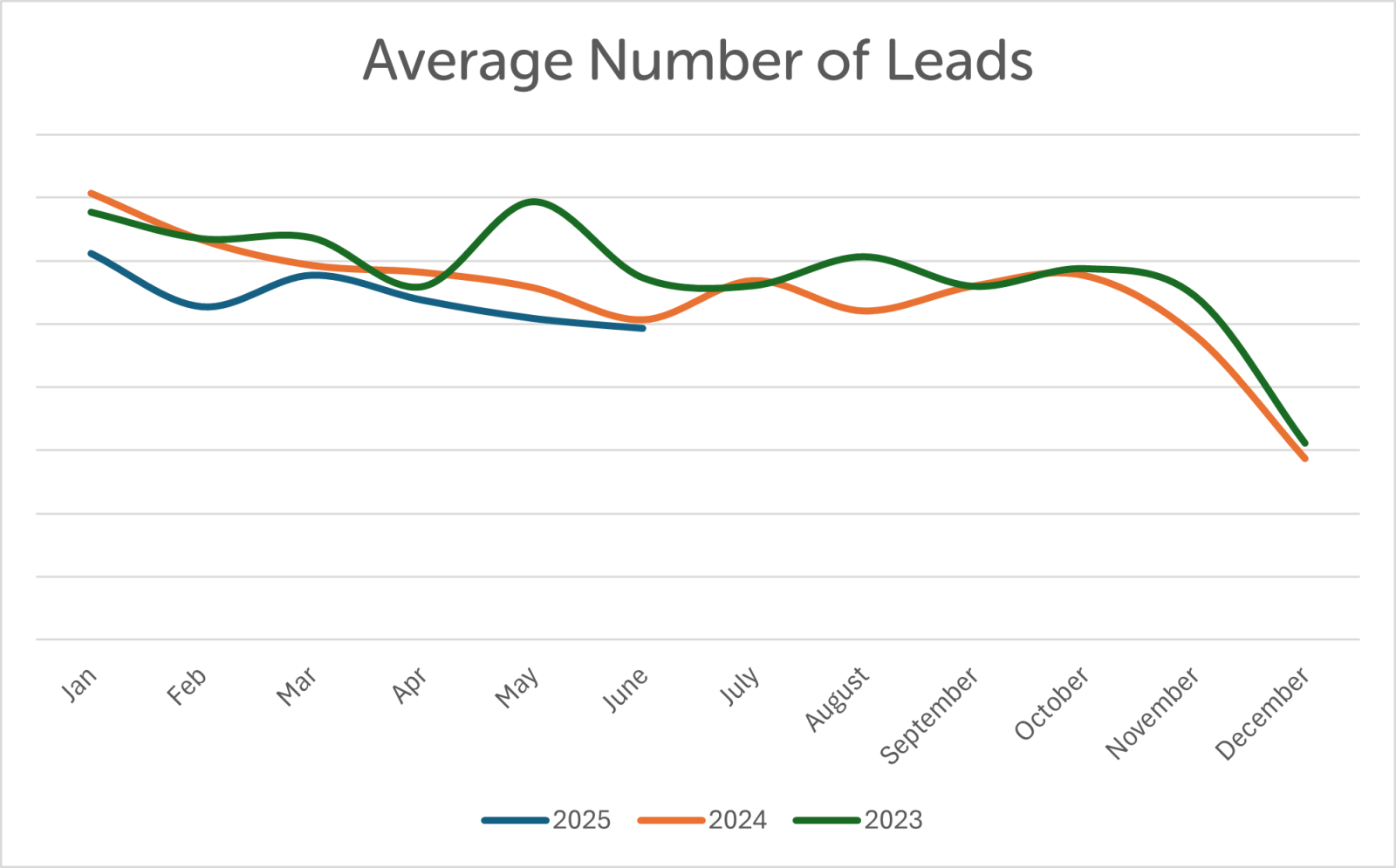

The average number of sales remained relatively consistent from January through to June, but leads have followed a slow decline in the first half of the year, except for an anomaly in March, where they peaked.

Average conversion rates have been creeping up – following a low of 39.5% in February 2025, they hit a high of 42.1% in June. This means that despite a rough and unpredictable market, with reduced leads, installers are working hard to make the most of every single enquiry that comes through the door.

From conversations with our installer community, this has become increasingly important since we saw the end of the Covid boom – they are having to work harder to win the sale from savvy homeowners who are doing their research and shopping around.

Whilst there are hints of positivity, there is no escaping the fact that in comparison to the last couple of years, there has been a significant dip in leads and sales.

Average leads are down by 9.4% compared to January to June 2024 and 14.7% down compared to January – June 2023.

Average sales are down 11.8% compared to January to June 2024 and 8.9% down compared to the same period in 2023.

What’s next?

With the labour market cooling following April’s increase in employer National Insurance contributions, it’s highly likely we’ll see another interest rate cut in August.

But the challenges aren’t going away. Economic uncertainty, real income pressure, and the ongoing cost-of-living crisis will continue to weigh on the market over the next six months.

For those involved in new-build, the Government’s push to build 370,000 new homes every year, supported by a £39bn cash injection for affordable housing, will present opportunities.

The Warm Homes: Local Grant scheme, that aims to upgrade 5 million homes over the next five years in a bid to cut fuel poverty, is also presenting opportunities. But only for those installers who are registered with TrustMark.

In better news for retail window and door installers, the 2025 UK Houzz & Home Renovation Trends Study found that 49% of UK homeowners planned to carry out renovations in 2025.

Meanwhile, consumer lending specialist, Pepper Money, said there had been a marked increase in secure loans to fund home improvements as homeowners faced steep mortgage rates, limited housing supply and high relocation costs. Home improvement loans now account for 9.7% of all borrowing – making them the second most popular reason for taking out a loan in the UK and reigniting the ‘improve don’t move’ trend.

As we always say at Business Pilot: know your own numbers. When the market is unpredictable, being able to track performance, profitability, and ROI becomes even more critical.

It’s the businesses with clear plans, solid strategies, and the right systems in place that will continue to ride out the storm.